Real estate investment is one of the most reliable ways to build long-term wealth. Unlike many other investments, property offers both regular income and the potential for value appreciation over time. For beginners, the idea of investing in real estate may seem complicated, but with the right knowledge and strategy, it can be a rewarding journey.

This beginner’s guide will help you understand the fundamentals of real estate investment and how to take your first steps confidently.

What Is Real Estate Investment?

Real estate investment involves purchasing property with the goal of generating income or profit. This can be done through rental income, property appreciation, or both. Investors typically choose properties based on location, market demand, and potential returns.

Types of Real Estate Investments

Understanding different property types is essential before making an investment decision.

1. Residential Properties

These include apartments, houses, and condominiums. They are popular among beginners because they are easier to understand and manage.

2. Commercial Properties

Office buildings, retail shops, and warehouses fall into this category. They usually offer higher returns but require larger investments.

3. Rental Properties

Properties purchased specifically to rent out and generate monthly income.

4. Real Estate Investment Trusts (REITs)

REITs allow investors to invest in real estate without owning physical property. They are similar to stocks and can be a great option for beginners with limited capital.

Benefits of Real Estate Investment

1. Steady Income

Rental properties can provide a consistent monthly cash flow.

2. Property Appreciation

Real estate values generally increase over time, offering long-term profits.

3. Tax Advantages

Investors may benefit from deductions on mortgage interest, maintenance, and depreciation.

4. Portfolio Diversification

Real estate adds stability to an investment portfolio, reducing overall risk.

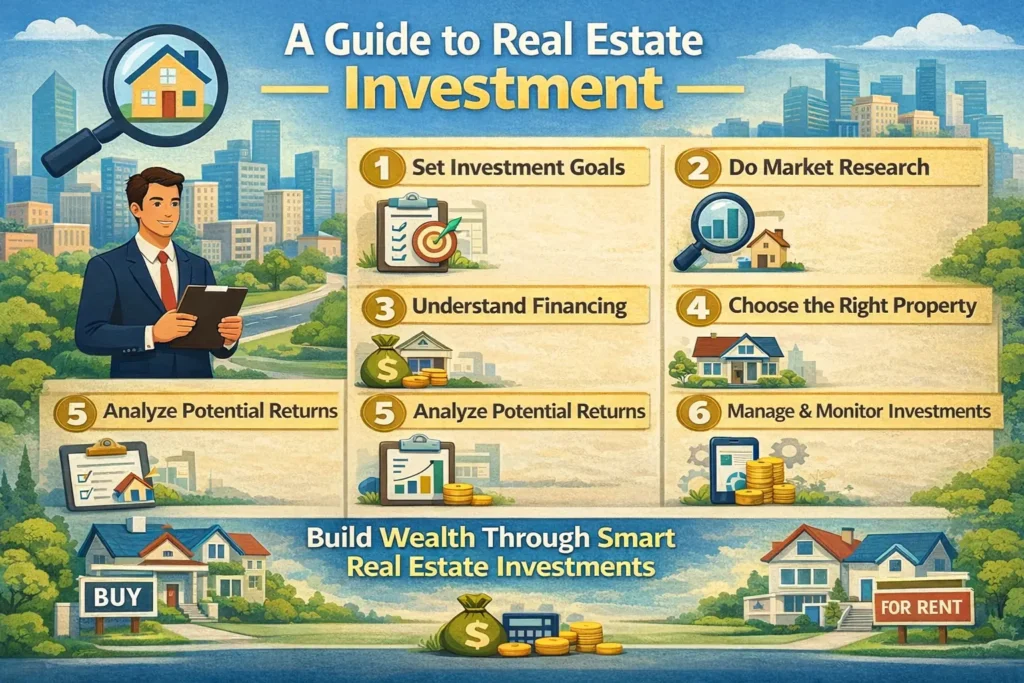

Steps to Start Investing in Real Estate

1. Set Your Investment Goals

Decide whether you want regular rental income, long-term appreciation, or both.

2. Understand Your Budget

Assess your savings, credit score, and financing options.

3. Research the Market

Look for areas with strong demand, infrastructure development, and growth potential.

4. Choose the Right Property

Start with a property that matches your budget and investment goals.

5. Secure Financing

Explore home loans, investor loans, or partnerships.

6. Manage the Property

You can manage the property yourself or hire a professional property manager.

Types of Real Estate Investments

Understanding different property types is essential before making an investment decision.

1. Residential Properties

These include apartments, houses, and condominiums. They are popular among beginners because they are easier to understand and manage.

2. Commercial Properties

Office buildings, retail shops, and warehouses fall into this category. They usually offer higher returns but require larger investments.

3. Rental Properties

Properties purchased specifically to rent out and generate monthly income.

4. Real Estate Investment Trusts (REITs)

REITs allow investors to invest in real estate without owning physical property. They are similar to stocks and can be a great option for beginners with limited capital.

Benefits of Real Estate Investment

1. Steady Income

Rental properties can provide a consistent monthly cash flow.

2. Property Appreciation

Real estate values generally increase over time, offering long-term profits.

3. Tax Advantages

Investors may benefit from deductions on mortgage interest, maintenance, and depreciation.

4. Portfolio Diversification

Real estate adds stability to an investment portfolio, reducing overall risk.

Steps to Start Investing in Real Estate

1. Set Your Investment Goals

Decide whether you want regular rental income, long-term appreciation, or both.

2. Understand Your Budget

Assess your savings, credit score, and financing options.

3. Research the Market

Look for areas with strong demand, infrastructure development, and growth potential.

4. Choose the Right Property

Start with a property that matches your budget and investment goals.

5. Secure Financing

Explore home loans, investor loans, or partnerships.

6. Manage the Property

You can manage the property yourself or hire a professional property manager.

Types of Real Estate Investments

Understanding different property types is essential before making an investment decision.

1. Residential Properties

These include apartments, houses, and condominiums. They are popular among beginners because they are easier to understand and manage.

2. Commercial Properties

Office buildings, retail shops, and warehouses fall into this category. They usually offer higher returns but require larger investments.

3. Rental Properties

Properties purchased specifically to rent out and generate monthly income.

4. Real Estate Investment Trusts (REITs)

REITs allow investors to invest in real estate without owning physical property. They are similar to stocks and can be a great option for beginners with limited capital.

Benefits of Real Estate Investment

1. Steady Income

Rental properties can provide a consistent monthly cash flow.

2. Property Appreciation

Real estate values generally increase over time, offering long-term profits.

3. Tax Advantages

Investors may benefit from deductions on mortgage interest, maintenance, and depreciation.

4. Portfolio Diversification

Real estate adds stability to an investment portfolio, reducing overall risk.

Steps to Start Investing in Real Estate

1. Set Your Investment Goals

Decide whether you want regular rental income, long-term appreciation, or both.

2. Understand Your Budget

Assess your savings, credit score, and financing options.

3. Research the Market

Look for areas with strong demand, infrastructure development, and growth potential.

4. Choose the Right Property

Start with a property that matches your budget and investment goals.

5. Secure Financing

Explore home loans, investor loans, or partnerships.

6. Manage the Property

You can manage the property yourself or hire a professional property manager.

Common Mistakes Beginners Should Avoid

Not researching the market properly

Overpaying for a property

Ignoring additional costs like maintenance and taxes

Taking on too much debt

Expecting quick profits

Tips for First-Time Real Estate Investors

Start small and grow gradually

Invest in locations with future growth potential

Focus on properties with strong rental demand

Always calculate expected returns before buying

Keep a financial buffer for unexpected expenses

Conclusion

Real estate investment can be a powerful tool for building wealth, even for beginners. By understanding the basics, setting clear goals, and making informed decisions, you can create a strong foundation for long-term financial success. Start small, stay patient, and let your investments grow over time.